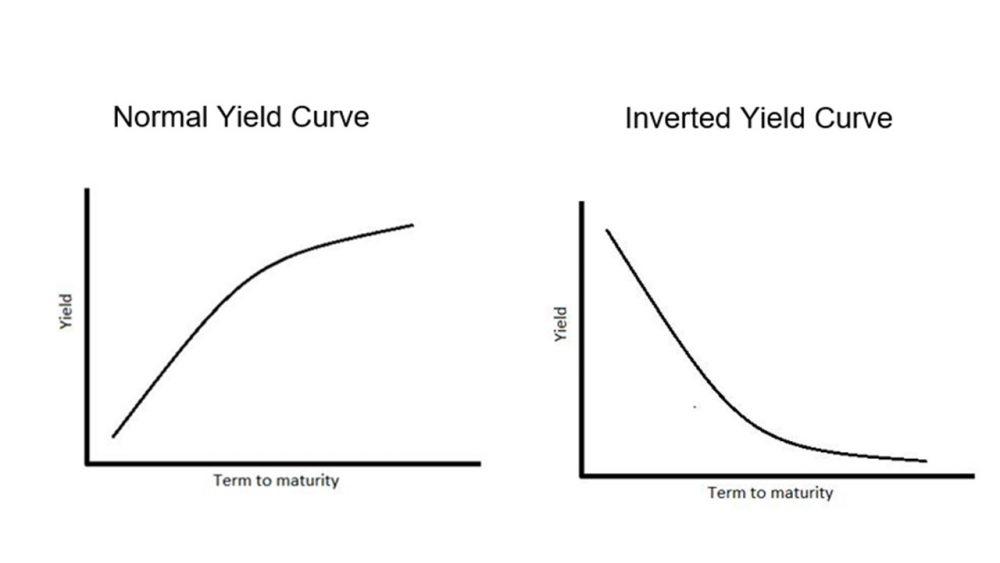

Inverted Yield Curve: A Head-Scratching Craze

Imagine a world where the interest rate paid on short-term loans exceeds the rate paid on long-term ones. It’s like a topsy-turvy universe where the time-honored conventions of finance have been flipped upside down. This is the perplexing phenomenon of an inverted yield curve, and it’s got everyone scratching their heads.

But what’s behind this unusual trend? Does it herald an impending recession or is it simply a temporary aberration? And what lessons can we glean from this financial conundrum? Join us as we delve into the inverted yield curve craze, unraveling its causes, implications, and the valuable insights it offers to investors, economists, and anyone with a keen interest in the ever-evolving landscape of finance. Get ready to embrace the enigmatic and potentially transformative world of inverted yield curves. Inverted yield curves have become a hot topic in financial media, but what do they really mean for investors? While a range of interpretations exists, one thing is clear: an inverted yield curve is a sign of caution. Historically, an inverted yield curve has preceded economic recessions. However, it’s important to note that not all inverted yield curves lead to recessions, and there may be other factors at play that could influence the economy’s direction.

If you’re concerned about the potential impact of an inverted yield curve on your investments, there are a few steps you can take to prepare. First, consider reviewing your portfolio and making adjustments to reduce your exposure to risk. This may include reducing your allocation to stocks and increasing your allocation to bonds. Second, stay informed about economic news and developments. The more you know about the factors that are influencing the economy, the better prepared you’ll be to make informed investment decisions.

In Conclusion

As we navigate the ever-fluctuating financial landscape, the inverted yield curve saga serves as a stark reminder that economic indicators can sometimes lead us down a rabbit hole of speculation and uncertainty. While the true implications of an inverted yield curve remain cloaked in a veil of complexity, it should not deter us from seeking knowledge and understanding. The journey itself, with its winding paths and unexpected turns, can teach us invaluable lessons about the intricate dance between financial markets and the broader economy. Let us continue to observe, analyze, and engage in thoughtful discussions, ensuring that the inverted yield curve craze does not lead us into the abyss of complacency but instead propels us toward a deeper comprehension of the financial world we inhabit.